Currently Empty: ₹0.00

A different way of looking at Options via Options Charts

Trading Options Based on Options Charts

Trade options better than ever before with Option Charts with this comprehensive course

Options Trading | OI and TOI | PCR | Identifying Momentum | Finding Low-Risk Trades | Objective Entries

Feedback

Reply comment Cancel reply

You must be logged in to reply this review.

Add a review Cancel reply

Reviews (82)

Watch Trailer

Learn objective methods for identifying low risk trading setup in this specialized options trading course

Dive into the world of Options trading

Discover a different way of looking at options charts to identify what the market is likely to do. Identify market trends and momentum to trade options smartly with this unique course.

- 4 hours of content

- 1 year validity

- Live Q&A

- Course in English

- Understand market trend

- Identify objective trades with P&F Charts

- Learn Option Charts analysis

- Learn OI analysis

Intraday | Positional | Directional | Straddles | Strangles | Options Charts | Market Trends | TOI | PCR | High - probability Patterns

What is this course?

Learn what option charts suggest about the market and gain a unique perspective, focusing on high-probability patterns and objective methods using Point & Figure charts.

With this course, you get to learn –

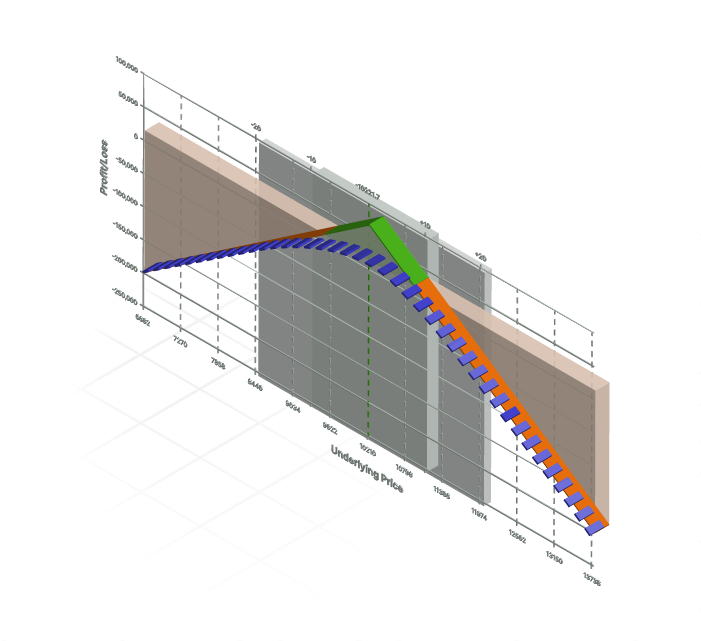

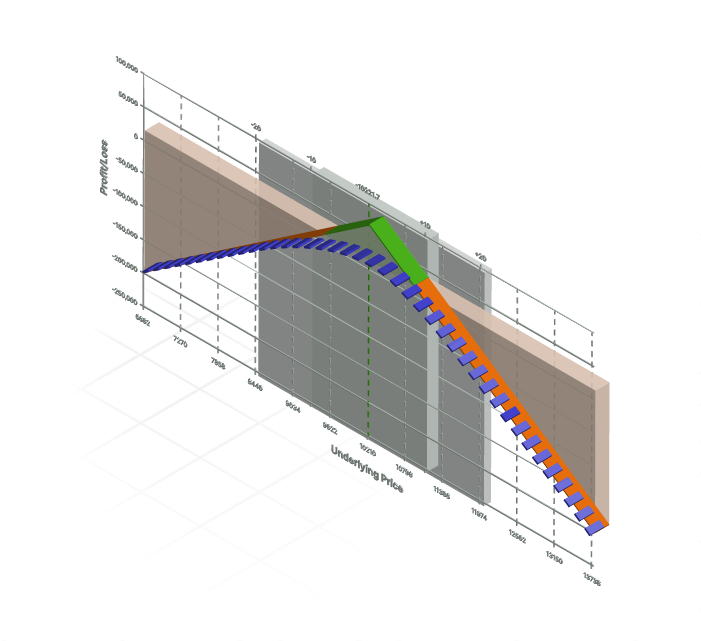

- Identifying low-risk trades – directional and non-directional

- Identifying sideways and trending phases

- Long and short option trades for indices as well as stocks

- Judging underlying trends with Total Open Interest (TOI)

- Open Interest (OI) and Put-Call Ratio (PCR)

- Identifying momentum

- Identifying intraday and positional trades

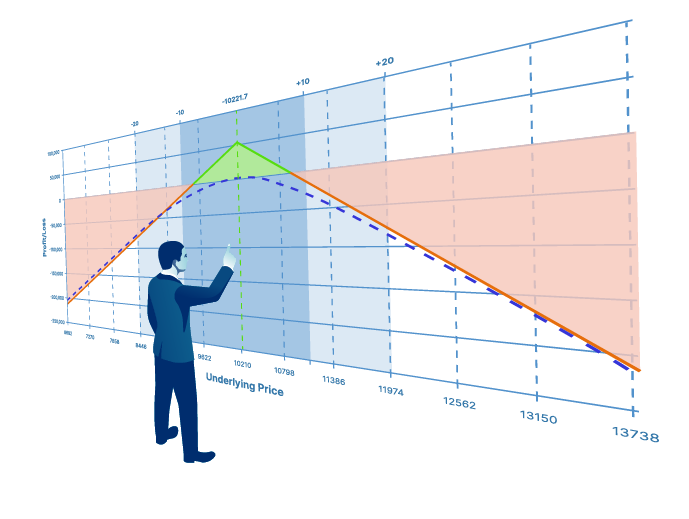

- Spreads, straddles/strangles and Iron Condors

- How option charts can guide your decisions

Option Charts Speak Volumes

When trading options, it is just as important to know what you should not do as it is to know what should be done. Learn to understand what option charts suggest and let them guide you through trades, whether intraday, positional, directional or non-directional. Learn unique strategies and techniques to trade options like a pro using P&F charts. Understand objective entries, discover objective methods of analysis and learn to identify trades and design effective trading strategies, guided by the options expert Abhijit Phatak.

Confusion to clarity

Execution is the key to successful trading. Most traders are unable to successfully implement their learnings due to confusion and lack of clarity.

This course is designed to impart the skills needed to cultivate clarity, enabling you to improve your trading and investment skills.

About Your Instructor

A Chemical engineer by education, Abhijit Phatak has spent the early part of his career in the international Oil and gas industry. With more than 20 years of experience in the stock market, he has devised strategies that work for new and seasoned traders alike. Owing to his passion for Technical Analysis, he has dedicated a large part of his career to looking for innovative methods to analyze the market. He has studied Options charts for almost 15 years and all these unique methods have been developed by him by observing them over the years.

With this course, he offers sustainable options analysis and trading guidance that uses Options charts to identify what the market is likely to do and make informed decisions. He offers unique techniques and objective methods backed by years of analysis and research. He is helping traders hone their skills and ace the art of options trading with this course.

Frequently Asked Questions

Yes. This course is suitable for both new and seasoned options traders. It is advisable to have a basic understanding of options trading and options charts for the course.

This course is a comprehensive guide to learning options trading using option charts. You will learn how to make objective entries, understand Open Interest (OI) and Put Call Ratio (PCR), identify momentum, and discover low-risk trades with high-probability patterns and objective methods. You will learn to identify market trends, trade types and unique techniques for analysis and trading.

Yes. After the successful completion of the course and its final assessment, you will gain a certification for the course.

Though the course is fit for both new and experienced traders, having a basic knowledge of options trading is necessary.

To help you get your queries resolved by our options trading mentor Abhijit Phatak, we will be organizing Live Q&A sessions via regular webinars. All course participants will be informed about these webinars and to join, you will need to register for them.

This course offers 4 hours of educational content on options trading, divided in 8 chapters.

No. This is a self-paced course, and you will gain access to it for 1 year from your date of enrollment. You can complete the course at your own convenience.

Recent Course

Feedback

Reply comment Cancel reply

You must be logged in to reply this review.

Add a review Cancel reply

Reviews (82)

-

-

-

Ashwamedh Kumar

October 26, 2025Its one of the best course on options. Concept got crystal clear. If any body wants to make carrier in trading must watch and implement the strategy discussed here

-

-

Santosh Kumar

September 19, 2025The course was packed with useful info and got straight to the point, which was great. But honestly, I think it would have been even better with more chart examples. A lot of us felt that spending extra time on charts would really help us get a better grasp. Using a pen to highlight stuff on the charts could make things clearer too. Plus, the screens were flipping by pretty fast, making it hard to keep up sometimes. All in all, I enjoyed the course and just wanted to say thanks for all the effort you put into it!

-

guru kiran ramadasa

September 13, 2025Please please use the pen when showing the entry, exit levels on the chart as cursor is not properly visible. The course is good. However, I felt the course was short as showing more examples would have been more beneficial. Thank you.

-

Praafull Bakshi

September 7, 2025Great course for the Option traders. All relevant strategies like Intraday, Positional, Non-Directional is covered along with the clear and objective trading rules. Monthly Q&A is cheery on the top.

Absolutely recommended, you get much much more than what you pay, cheers! -

Darshan Mehta

September 7, 2025This course presents a carefully structured trading system taught by AP Sir. Lessons are delivered step-by-step with candid discussions of pros and cons, and practical guidance on which actions to avoid. By following the chart-based rules he teaches and removing speculative noise, learners significantly reduce the risk of long-term losses. Clear, practical, and well suited for anyone serious about disciplined trading.

-

Shubham Bhoyar

September 1, 2025video should be downloaded so we can watch video in offline mode also

-

MOHANLAL PADHI

August 31, 2025Surely this Option Course is of great help to us. The Objectivity of P&F charts in option trading along with TOI , Intraday Camarilla levels and Adaptive RSI is very clearly explained by AP Sir. On top of all these guidelines on SL & Trailing SL section are very well explained.

Although these are more than enough for any F&O traders, Still DIL MANGE MORE !!! I would like to hear more on adjustment part in Iron Condor, Butterfly and Batman Strategies along with how to adjust them when needed by using P&F charts.

Many Thanks for your guidance and support. -

Ram Ayachit

August 24, 2025This course is Crisp, Objective and Clear. Clarity on what not to do and what to do is best thing I liked in this course. Trade what you see and not what you feel is the punch.

-

Ashwamedh Kumar

August 19, 2025Very well taught and nice content. All topics gets cleared

-

Chidambar Kulkarni

August 18, 2025The course was really. It changed perspective on trading options. Trading options from chart is really nice. I used to trade it. But it was random. As have learned this objective ways this will be helpful

-

-

-

-

Deepanshu Aggarwal

June 17, 2025The Options Strategy course is excellent! It provides a clear, practical understanding of various option strategies with real-world examples. The concepts are well-structured and easy to grasp, making it highly valuable for both beginners and experienced traders. Highly recommended for anyone looking to strengthen their options trading skills.

-

pradeep kavadia

June 16, 2025strategies understood well with noiseless charts and techniques which lack, after this course i perform better and quickly come to positive returns.

-

Vaibhav Gupta

May 15, 2025Wonderful course ! Concepts explained with excellent clarity

-

Hemant Verma

May 2, 2025I enrolled for the course considering that I will be a better option trader after gaining the knowledge from AP sir. However, it didn’t go well for me.

I find the lectures and explanation too complicated for me to understand.

I do not have any PRO subscription of Tradepoint/Rzone/Opstra so I was not able to use their TOI feature.

One more pain point was that this course has limited validity, so if you want to refresh the topics you can’t do this. -

Hemant Verma

May 2, 2025I enrolled for the course considering that I will be a better option trader after gaining the knowledge from AP sir. However, it didn’t go well for me.

I find the lectures and explanation too complicated for me to understand.

I do not have any PRO subscription of Tradepoint/Rzone/Opstra so I was not able to use their TOI feature.

One more pain point was that this course has limited validity, so if you want to refresh the topics you can’t do this. -

Prashant Hakani

April 25, 2025Overall course is fine but it seems AP sir was in hurry to conclude the course.

There should be more practical examples of each chapter in different different scenarios… mostly only success part of the strategy shown it should include difficult scenarios of strategy too. -

Pawan Agarwal

April 21, 2025Although i missed Live QNA but the sessions are indeed insightful with lots of learnings.AP Sir is very much cooperative with each one with the queries solving in a simple n practical approach.

-

MUNJESH SINGH

March 27, 2025More example must shown in ppt format for deep under standing .anyhow course was sup rub

-

Purav Choksi HUF

March 22, 2025Important aspect of Calendar Strategies have been missed

Lot of the points discussed by AP Sir have been covered by him on various platforms. For a paid coure had expected some more new concepts or systems to be discussed.

Overall good experience to hear from the Master.Thank you

-

Kishor Jadhav

March 16, 2025Great course and handholding in the form of q&a and telegram group great.thank you

-

Santosh Kumar

February 18, 2025The content was exceptionally well explained and very crisp, making complex concepts easy to understand. I truly believe that the insights I’ve gained will significantly enhance my trading strategies and overall approach to options trading.

Thank you for your effort in delivering such a valuable experience. I’m looking forward to applying what I’ve learned!

-

-

Venkata Krishnan

January 26, 2025Extremely good

Every revision gives a few additional points to ponder and digest

It is like reading Bhagavath Gita. It is said that Gita gives different meaning each time you read it.

Like that, each time I go through the course contents and Webinars, it adds a new dimension.

Hats Off

Thanks and regards -

Deepak Vijay

January 24, 2025Thanks for the explaining the concepts in clear, objective & practical way

-

BALAKRISHNA P.

December 17, 2024AP Sir knowledge on options and the way he impartts knowlede is beautiful . He has covered from basic charts to advanced strategies In a very simple manner.

i have gone through recording many number of times , each time I have learnt a new thing.

Kudoos to AP Sir. He is great teacher.. -

Harpreet Singh

December 8, 2024AP Sir’s Gurukul course is awesome! 🎯 He makes options trading so easy to understand, starting from the basics to advanced strategies. The lessons are super practical with real examples that boost confidence. 💡 AP Sir is very knowledgeable and answers all questions clearly.

This course really helped me improve my trading skills. Highly recommended! 🚀

-

-

sachin mehta

October 31, 2024Very good course which gives complete insights looking at the options charts to decide the trade.

-

Suchit Patel

October 28, 2024Very good insight on options trading using price action, keeping things simple. Great Course for people looking for options trading using price action.

-

saumitra nisal

October 9, 2024The best course for any option trader. AP sir is just amazing. He teaches everything. Thank you for such a wonderful course.

-

-

Rajinder singh

September 11, 2024Excellent and value for money. Really enjoy the whole Course and learnt so much.

-

-

Chandrashekhar Choudhari

August 31, 2024A successful attempt to cover all the topics in a single course in very few words. This is Gurukul🙏

Thanks -

Sanjay Sharma

August 25, 20240Very informative and objective way to trade. Reduce the noice

-

DT Bhat

July 21, 2024I learnt very objective way of trading options with least adjustments. The passion with which the instructor teaches the course makes us confident and will help us psychologically in trading options.

-

-

Ravi Shinde

June 24, 2024This course is more than sufficient if one wants to start trading the options. Once you understand the straddles completely, you would understand the market behavior. The Straddle,Strangle,Multileg charts and TOI is a complete package for the options trading and if it is done with the discipline, results are going to be absolutely amazing. AP sir is amazing mentor who kind of invented these options charts and made the complex instruments tradable easily for novice traders. His contribution to the options trading in India is commendable. I highly recommend this course.

-

-

RUCHIR DANI

May 28, 2024Extremely practical course.

Very well explained.

Difficult techniques made simple. -

Sanjay Joshi

May 23, 2024Very Good Course AP Sir. It clearly defines entries, exits, Stop loss. Strategies are also well explained. charts are noiseless, now our mind has to make noiseless. It will require lot of practice to follow rule base method.

-

Sanjay Joshi

May 23, 2024Very Good Course AP Sir. It clearly defines entries, exits, Stop loss. Strategies are also well explained. charts are noiseless, now our mind has to make noiseless. It will require lot of practice to follow rule base method. Many Thanks to Team Definedge also for making such a wonderful and useful charting and scanners.

-

Lakshmi Yerrabelli

May 8, 2024Felling fortunate to connect with such an experienced people @Definedge, who are very kind to share their experiences and suggest best practices.

Kudos to AP sir for such a systematic and crystal clear way of arranging the topics and i really appreciate the consistency (i watched almost all of your videos) with which you speak and answer the repetitive questions so patiently in a very consistent manner.

Greatfull to all the leadership team at Definedge, you are all very open, ground to earth and very kind to share your knowledge.

Regards

Jagadheeshwar -

Bhuvaneshwari Hegde

May 2, 2024Fantastic course. but i need to go thru it again and again to instill in my mind. can we have practice sessions? that will be useful.

-

Atul Sharma

May 1, 2024This Was Something Else I have never thought trading like this. This is amazing. I have become fan of strangles with the help of charts and vertical spreads.

Thank u Abhijeet Sir This is a real Eye opener.👌 -

-

ram jasti

April 24, 2024Excellent course for options trading, genuine and realistic.

-

-

-

-

-

Sameer Wakde

April 11, 2024Since I joined the course, I have remarkable improved the trading. I am learning and still do mistakes, but now there is clear objectivity in the trading. SL is clearly defined and hence affordability can be judge before entering the trade.

-

-

Pinaki Sengupta

March 31, 2024An excellent course to learn option trading from a very knowledgeable, experienced market veteran. helpful to separate Chaff from the staff. Could have been better if AP sir could have shown some example on USDINR or Gold

-

nayan shah

March 28, 2024Have taken several option courses from multiple sources but by attending this course it give you complete objectivity and practical approach towards trading and clears all your confusion where you know what to do and more importantly what not to do

-

Vishwanath Nagaraj

March 28, 2024This is simply exceptional and well put. the biggest takeaway for me these are for consistent results and not your multibaggers. Keep up the great work 🙂

-

atul meshram

March 23, 2024implementing TOI in intraday mcx CRUDE trading. if you could have touched that topic it will have wonder results for me. but no worry i am just putting values and experimenting and getting good results.

THANKS DEFINEDGE. -

Amitabh Bhasin

March 21, 2024Course is good but it could have been made better. Slides regarding what steps are to be followed, box sizes etc should be there. How to place orders because by the time option gives a DTB, price has already run up very much.

-

Ujjal Kesh

March 20, 2024Excellent practical application with structured inter day option trading set up. It is really helpful for option inter day

-

Rushikesh Mane

March 17, 2024Thank you so much AP sir for giving us the knowledge or crucks of your 20 years of experience on option previously I could not know how to do adjecement on option but now I am very clear one does not need to make it complicated by doing such adjecetment on option also this course helps when to go directional and when to go non- directonal so thank you so much sir I am looking ahead when I am going to come to meet and be thankful to you again thank you so much sir god bless you with lots of health and wealth and prosparity thanks again

-

-

Suresh S

March 16, 2024Hello Sir,

It is Very Nice course. I am regular option trader, There are lot of things to learn in this course. Some of the sessions went 2-3 times to get god understanding. More than entry I have problems with exiting the trade. Here This is illustrated nicely.

-

atul meshram

March 10, 2024no complaining just observation

1)content already on your youtube channel

2) not much content other than that

3) prashant sir started in his course everything from scratch.

4) you started as everybody who attending your course is already master in everything.

5)you didt shown in chart how to plot all you thought and how to interpret all signals ,if coming more, like if there is whip saw in toi then what to do.

6) box values you told in that hurry as everybody knows everything about that.

7)overall i thought you were in hurry and you made this course for professionals. -

Jainam Jain

March 10, 2024For intraday setup how to choose stocks out of all liquid stock

-

MANJUNATHA AV

March 9, 2024Dear sir,

I have learned a lot from this course. Sincerely, thank you for you contribution in educating and hand holding many traders like me.

-

subramanya joshi

March 9, 2024Thank You Ap sir, this course is very good and one clear think noise of charts and mind should be avoided, one small suggestion is that let’s us how to identify the stocks for intraday and swing trade which has potential of 3 to 5% move.

Once again thanks a you so much

-

ganesh bedarkar

March 3, 2024Nice session sir Thanku , I have questions. 1) in vertical spread can we plot monthly expiry only .so how many days before it .2 ) can we plot vertically spread in weekly’s

-

GUTTIKONDA VENKATA SAI

March 1, 2024Very well explained. I have started trading straddles and strangles using method explained in the course. Looking forward to Q&A sessions,

-

TEJPREET SINGH

February 26, 2024Abhijeet Pathak saw your options training on e Gurukul👌. Guys being a seasoned pro trader with 23 years in market it’s almost the same thing which I know and have seen many times but Abhijeet Pathak’s passion for charts and ease of teaching is amazing. Every session is worth the time spent on watching it. A must watch for all option traders wether new or seasoned one’s. Just go for it!!!

-

sridhar v

February 26, 2024Thanks a lot sir for the wonderful course. Few more in details would have helped a lot more like various box sizes for intraday and positional for for index and stocks. More examples of index intraday. All these point in a powerpoint will be more easy to follow

-

Dhanapal PERIASAMY

February 25, 2024Really an eye opener for options trader. What not to do is very clear which will keep a trader long in business, this has done that very well. As an option buyer I have learned insights on how to trade and maintain R:R.

-

Saify Arsiwala

February 24, 2024Sir, another small suggestion would be to have a small downloadable template for box sizes in different scenarios eg 3%for long options positional etc and entry and exit patterns.

It would be handy for the beginners.

Thanks. -

Saify Arsiwala

February 24, 2024AP Sir,

The course is fantastic.

Even a professional like me who has nothing to do with finance remotely could understand the objectivity.

You have shown your ability to explain well all the ways to trade options.

It was an eye opener for me.

Thank you once again. -

DHANANJAY KULKARNI

February 22, 2024Dear Abhijit Sir,

The course is fantastic & covers very important concepts. It helped me to look at the markets from a different point of view rather than just looking at charts with a bunch of indicators. You gave me a whole new tangent to look at the market now. Your trading philosophy resonates with what I am trying to achieve in the market so I feel I am at the right place. I am looking forward to more courses by you and will be the first to enroll after it launches. I am already connected on Twitter with you and I will surely ask you questions once I thoroughly apply the concepts taught in this course. Gratitude … -

Ashok Prasun

February 21, 2024Thanks AP SIR. Actually the knowledge you gave here is already available on your YouTube,but thus course have made that knowledge a process oriented, which is not available on you tube, by taking the course I understand when to open which chart . Thank you sir, looking forward to practice on the concepts told herein

-

Makrand Thakre

February 21, 2024Dear Abhijit Sir,

You are a great teacher…thank you for the course

But you have already made vedios on contents like TOI, intraday options, positional options, straddles which are FREELY available on YouTube…

The course could have been more exclusive for the paid memberships-

Saify Arsiwala

February 24, 2024The you tube channel ,is random.

Whereas the course is systematic.

One video may not explain everything.

So the order of course is important to learn for beginners.

Helly Bhatt

Good

Harshit Patnaik

Excellent course for intermediate guys 5/5

Ashwamedh Kumar

Its one of the best course on options. Concept got crystal clear. If any body wants to make carrier in trading must watch and implement the strategy discussed here

Rushikesh Mane

wonderful and very insightful course

Santosh Kumar

The course was packed with useful info and got straight to the point, which was great. But honestly, I think it would have been even better with more chart examples. A lot of us felt that spending extra time on charts would really help us get a better grasp. Using a pen to highlight stuff on the charts could make things clearer too. Plus, the screens were flipping by pretty fast, making it hard to keep up sometimes. All in all, I enjoyed the course and just wanted to say thanks for all the effort you put into it!

guru kiran ramadasa

Please please use the pen when showing the entry, exit levels on the chart as cursor is not properly visible. The course is good. However, I felt the course was short as showing more examples would have been more beneficial. Thank you.

Praafull Bakshi

Great course for the Option traders. All relevant strategies like Intraday, Positional, Non-Directional is covered along with the clear and objective trading rules. Monthly Q&A is cheery on the top.

Absolutely recommended, you get much much more than what you pay, cheers!

Darshan Mehta

This course presents a carefully structured trading system taught by AP Sir. Lessons are delivered step-by-step with candid discussions of pros and cons, and practical guidance on which actions to avoid. By following the chart-based rules he teaches and removing speculative noise, learners significantly reduce the risk of long-term losses. Clear, practical, and well suited for anyone serious about disciplined trading.

Shubham Bhoyar

video should be downloaded so we can watch video in offline mode also

MOHANLAL PADHI

Surely this Option Course is of great help to us. The Objectivity of P&F charts in option trading along with TOI , Intraday Camarilla levels and Adaptive RSI is very clearly explained by AP Sir. On top of all these guidelines on SL & Trailing SL section are very well explained.

Although these are more than enough for any F&O traders, Still DIL MANGE MORE !!! I would like to hear more on adjustment part in Iron Condor, Butterfly and Batman Strategies along with how to adjust them when needed by using P&F charts.

Many Thanks for your guidance and support.

Ram Ayachit

This course is Crisp, Objective and Clear. Clarity on what not to do and what to do is best thing I liked in this course. Trade what you see and not what you feel is the punch.

Ashwamedh Kumar

Very well taught and nice content. All topics gets cleared

Chidambar Kulkarni

The course was really. It changed perspective on trading options. Trading options from chart is really nice. I used to trade it. But it was random. As have learned this objective ways this will be helpful

Shailendra Mashalkar

Lot of objectivity after the course. Thank You

Vitta Solutions

Great Insights!!!

sai chaitanya tirupati

Really nice course

Deepanshu Aggarwal

The Options Strategy course is excellent! It provides a clear, practical understanding of various option strategies with real-world examples. The concepts are well-structured and easy to grasp, making it highly valuable for both beginners and experienced traders. Highly recommended for anyone looking to strengthen their options trading skills.

pradeep kavadia

strategies understood well with noiseless charts and techniques which lack, after this course i perform better and quickly come to positive returns.

Vaibhav Gupta

Wonderful course ! Concepts explained with excellent clarity

Hemant Verma

I enrolled for the course considering that I will be a better option trader after gaining the knowledge from AP sir. However, it didn’t go well for me.

I find the lectures and explanation too complicated for me to understand.

I do not have any PRO subscription of Tradepoint/Rzone/Opstra so I was not able to use their TOI feature.

One more pain point was that this course has limited validity, so if you want to refresh the topics you can’t do this.

Hemant Verma

I enrolled for the course considering that I will be a better option trader after gaining the knowledge from AP sir. However, it didn’t go well for me.

I find the lectures and explanation too complicated for me to understand.

I do not have any PRO subscription of Tradepoint/Rzone/Opstra so I was not able to use their TOI feature.

One more pain point was that this course has limited validity, so if you want to refresh the topics you can’t do this.

Prashant Hakani

Overall course is fine but it seems AP sir was in hurry to conclude the course.

There should be more practical examples of each chapter in different different scenarios… mostly only success part of the strategy shown it should include difficult scenarios of strategy too.

Pawan Agarwal

Although i missed Live QNA but the sessions are indeed insightful with lots of learnings.AP Sir is very much cooperative with each one with the queries solving in a simple n practical approach.

MUNJESH SINGH

More example must shown in ppt format for deep under standing .anyhow course was sup rub

Purav Choksi HUF

Important aspect of Calendar Strategies have been missed

Lot of the points discussed by AP Sir have been covered by him on various platforms. For a paid coure had expected some more new concepts or systems to be discussed.

Overall good experience to hear from the Master.

Thank you

Kishor Jadhav

Great course and handholding in the form of q&a and telegram group great.thank you

Santosh Kumar

The content was exceptionally well explained and very crisp, making complex concepts easy to understand. I truly believe that the insights I’ve gained will significantly enhance my trading strategies and overall approach to options trading.

Thank you for your effort in delivering such a valuable experience. I’m looking forward to applying what I’ve learned!

MUNJESH SINGH

Sup rub course by AP Sir

Venkata Krishnan

Extremely good

Every revision gives a few additional points to ponder and digest

It is like reading Bhagavath Gita. It is said that Gita gives different meaning each time you read it.

Like that, each time I go through the course contents and Webinars, it adds a new dimension.

Hats Off

Thanks and regards

Deepak Vijay

Thanks for the explaining the concepts in clear, objective & practical way

BALAKRISHNA P.

AP Sir knowledge on options and the way he impartts knowlede is beautiful . He has covered from basic charts to advanced strategies In a very simple manner.

i have gone through recording many number of times , each time I have learnt a new thing.

Kudoos to AP Sir. He is great teacher..

Harpreet Singh

AP Sir’s Gurukul course is awesome! 🎯 He makes options trading so easy to understand, starting from the basics to advanced strategies. The lessons are super practical with real examples that boost confidence. 💡 AP Sir is very knowledgeable and answers all questions clearly.

This course really helped me improve my trading skills. Highly recommended! 🚀

PRASAD MANJUSHA BHARGAV

EXCELLENT

sachin mehta

Very good course which gives complete insights looking at the options charts to decide the trade.

Suchit Patel

Very good insight on options trading using price action, keeping things simple. Great Course for people looking for options trading using price action.

saumitra nisal

The best course for any option trader. AP sir is just amazing. He teaches everything. Thank you for such a wonderful course.

Kaavya Kanagaraj

TOI & PCR part

Rajinder singh

Excellent and value for money. Really enjoy the whole Course and learnt so much.

Hrishikesh Gadage

Learnt a objective way of trading options.

Chandrashekhar Choudhari

A successful attempt to cover all the topics in a single course in very few words. This is Gurukul🙏

Thanks

Sanjay Sharma

0Very informative and objective way to trade. Reduce the noice

DT Bhat

I learnt very objective way of trading options with least adjustments. The passion with which the instructor teaches the course makes us confident and will help us psychologically in trading options.

Dilip Shah

Excellent and value for money….

Ravi Shinde

This course is more than sufficient if one wants to start trading the options. Once you understand the straddles completely, you would understand the market behavior. The Straddle,Strangle,Multileg charts and TOI is a complete package for the options trading and if it is done with the discipline, results are going to be absolutely amazing. AP sir is amazing mentor who kind of invented these options charts and made the complex instruments tradable easily for novice traders. His contribution to the options trading in India is commendable. I highly recommend this course.

Pinaki Sengupta

Excellent course

RUCHIR DANI

Extremely practical course.

Very well explained.

Difficult techniques made simple.

Sanjay Joshi

Very Good Course AP Sir. It clearly defines entries, exits, Stop loss. Strategies are also well explained. charts are noiseless, now our mind has to make noiseless. It will require lot of practice to follow rule base method.

Sanjay Joshi

Very Good Course AP Sir. It clearly defines entries, exits, Stop loss. Strategies are also well explained. charts are noiseless, now our mind has to make noiseless. It will require lot of practice to follow rule base method. Many Thanks to Team Definedge also for making such a wonderful and useful charting and scanners.

Lakshmi Yerrabelli

Felling fortunate to connect with such an experienced people @Definedge, who are very kind to share their experiences and suggest best practices.

Kudos to AP sir for such a systematic and crystal clear way of arranging the topics and i really appreciate the consistency (i watched almost all of your videos) with which you speak and answer the repetitive questions so patiently in a very consistent manner.

Greatfull to all the leadership team at Definedge, you are all very open, ground to earth and very kind to share your knowledge.

Regards

Jagadheeshwar

Bhuvaneshwari Hegde

Fantastic course. but i need to go thru it again and again to instill in my mind. can we have practice sessions? that will be useful.

Atul Sharma

This Was Something Else I have never thought trading like this. This is amazing. I have become fan of strangles with the help of charts and vertical spreads.

Thank u Abhijeet Sir This is a real Eye opener.👌

Vinit Choudhary

Excellent course for options trading

ram jasti

Excellent course for options trading, genuine and realistic.

Tushar Shirolkar

Nice Course on Options.

RAJ KUMAR

nice course

Jahan Mohan Kuppuswami

Very practical and informative,

G BOWYA

The course is Good.

Sameer Wakde

Since I joined the course, I have remarkable improved the trading. I am learning and still do mistakes, but now there is clear objectivity in the trading. SL is clearly defined and hence affordability can be judge before entering the trade.

ASHOKKUMAR CHUDASAMA

Excellent Excellent and only Excellent

Pinaki Sengupta

An excellent course to learn option trading from a very knowledgeable, experienced market veteran. helpful to separate Chaff from the staff. Could have been better if AP sir could have shown some example on USDINR or Gold

nayan shah

Have taken several option courses from multiple sources but by attending this course it give you complete objectivity and practical approach towards trading and clears all your confusion where you know what to do and more importantly what not to do

Vishwanath Nagaraj

This is simply exceptional and well put. the biggest takeaway for me these are for consistent results and not your multibaggers. Keep up the great work 🙂

atul meshram

implementing TOI in intraday mcx CRUDE trading. if you could have touched that topic it will have wonder results for me. but no worry i am just putting values and experimenting and getting good results.

THANKS DEFINEDGE.

Amitabh Bhasin

Course is good but it could have been made better. Slides regarding what steps are to be followed, box sizes etc should be there. How to place orders because by the time option gives a DTB, price has already run up very much.

Ujjal Kesh

Excellent practical application with structured inter day option trading set up. It is really helpful for option inter day

Rushikesh Mane

Thank you so much AP sir for giving us the knowledge or crucks of your 20 years of experience on option previously I could not know how to do adjecement on option but now I am very clear one does not need to make it complicated by doing such adjecetment on option also this course helps when to go directional and when to go non- directonal so thank you so much sir I am looking ahead when I am going to come to meet and be thankful to you again thank you so much sir god bless you with lots of health and wealth and prosparity thanks again

Sanjiv Kumar

cource is good …thankyou for making the cource

Suresh S

Hello Sir,

It is Very Nice course. I am regular option trader, There are lot of things to learn in this course. Some of the sessions went 2-3 times to get god understanding. More than entry I have problems with exiting the trade. Here This is illustrated nicely.

atul meshram

no complaining just observation

1)content already on your youtube channel

2) not much content other than that

3) prashant sir started in his course everything from scratch.

4) you started as everybody who attending your course is already master in everything.

5)you didt shown in chart how to plot all you thought and how to interpret all signals ,if coming more, like if there is whip saw in toi then what to do.

6) box values you told in that hurry as everybody knows everything about that.

7)overall i thought you were in hurry and you made this course for professionals.

Jainam Jain

For intraday setup how to choose stocks out of all liquid stock

MANJUNATHA AV

Dear sir,

I have learned a lot from this course. Sincerely, thank you for you contribution in educating and hand holding many traders like me.

subramanya joshi

Thank You Ap sir, this course is very good and one clear think noise of charts and mind should be avoided, one small suggestion is that let’s us how to identify the stocks for intraday and swing trade which has potential of 3 to 5% move.

Once again thanks a you so much

ganesh bedarkar

Nice session sir Thanku , I have questions. 1) in vertical spread can we plot monthly expiry only .so how many days before it .2 ) can we plot vertically spread in weekly’s

GUTTIKONDA VENKATA SAI

Very well explained. I have started trading straddles and strangles using method explained in the course. Looking forward to Q&A sessions,

TEJPREET SINGH

Abhijeet Pathak saw your options training on e Gurukul👌. Guys being a seasoned pro trader with 23 years in market it’s almost the same thing which I know and have seen many times but Abhijeet Pathak’s passion for charts and ease of teaching is amazing. Every session is worth the time spent on watching it. A must watch for all option traders wether new or seasoned one’s. Just go for it!!!

sridhar v

Thanks a lot sir for the wonderful course. Few more in details would have helped a lot more like various box sizes for intraday and positional for for index and stocks. More examples of index intraday. All these point in a powerpoint will be more easy to follow

Dhanapal PERIASAMY

Really an eye opener for options trader. What not to do is very clear which will keep a trader long in business, this has done that very well. As an option buyer I have learned insights on how to trade and maintain R:R.

Saify Arsiwala

Sir, another small suggestion would be to have a small downloadable template for box sizes in different scenarios eg 3%for long options positional etc and entry and exit patterns.

It would be handy for the beginners.

Thanks.

Saify Arsiwala

AP Sir,

The course is fantastic.

Even a professional like me who has nothing to do with finance remotely could understand the objectivity.

You have shown your ability to explain well all the ways to trade options.

It was an eye opener for me.

Thank you once again.

DHANANJAY KULKARNI

Dear Abhijit Sir,

The course is fantastic & covers very important concepts. It helped me to look at the markets from a different point of view rather than just looking at charts with a bunch of indicators. You gave me a whole new tangent to look at the market now. Your trading philosophy resonates with what I am trying to achieve in the market so I feel I am at the right place. I am looking forward to more courses by you and will be the first to enroll after it launches. I am already connected on Twitter with you and I will surely ask you questions once I thoroughly apply the concepts taught in this course. Gratitude …

Ashok Prasun

Thanks AP SIR. Actually the knowledge you gave here is already available on your YouTube,but thus course have made that knowledge a process oriented, which is not available on you tube, by taking the course I understand when to open which chart . Thank you sir, looking forward to practice on the concepts told herein

Makrand Thakre

Dear Abhijit Sir,

You are a great teacher…thank you for the course

But you have already made vedios on contents like TOI, intraday options, positional options, straddles which are FREELY available on YouTube…

The course could have been more exclusive for the paid memberships

Saify Arsiwala

The you tube channel ,is random.

Whereas the course is systematic.

One video may not explain everything.

So the order of course is important to learn for beginners.